Every golfer knows the importance of patience, rhythm and a clear game plan.

Success on the course rarely comes from chasing every drive, it comes from steady improvements that compound over time. The same thinking applies when it comes to your money.

For Australians who want their savings to perform without the daily stress of share market swings, TermPlus provides access to the global private credit market, one of the fastest growing investment classes of the past 15 years. Once reserved for large institutions, this market is now open to everyday investors with as little as $2,000.

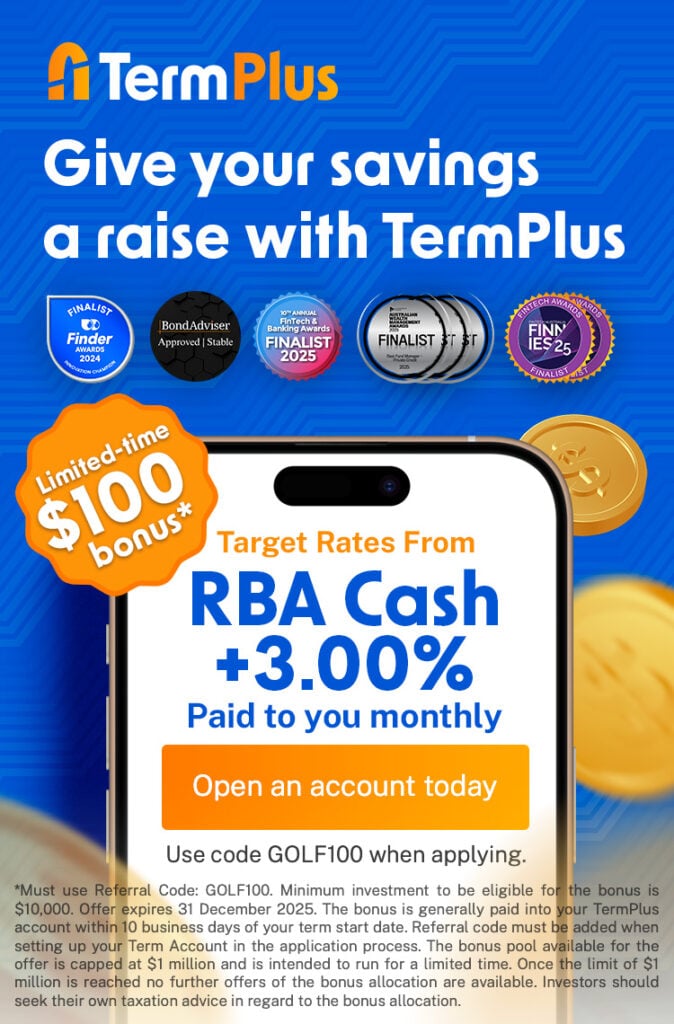

Investors can select a one, two or five-year term, with targeted returns set at a fixed margin above the RBA Cash Rate, between 3 and 4.15 percent per annum depending on the term chosen. Each month, income can be paid directly into a bank account, helping with club fees, a new set of irons or that long-planned golf holiday. Alternatively, it can be reinvested to compound over time.

Behind the scenes, funds are spread across more than 3,500 private loans to established mid-market businesses across the globe, primarily in the US and Europe. These companies typically operate in non-cyclical industries, with strong free cash flow, helping smooth out the volatility that can make the share market feel like playing a round in heavy winds. Every TermPlus account is also supported by a unique Support Account, a pool of capital co-invested alongside customers, providing the kind of extra buffer every golfer appreciates when trying to keep the ball safely in play.

TermPlus caters to all sorts of investors. Investors can open personal accounts, joint accounts, child accounts, company or trust accounts and even SMSF accounts, making it accessible to a wide range of Australians looking for attractive and reliable monthly income. The online application is simple and takes as little as three minutes to set up. The term accounts have already been recognised as finalists in national investment innovation awards, and much like posting a reliable scorecard round after round, TermPlus is earning the trust of investors through consistency and results.

For golfers, it is about keeping your head down, staying focused and trusting the process. With TermPlus, your money is given the same structure, letting you enjoy the freedom of the fairways while your savings work quietly in the background.

Learn more at termplus.com.au – because it is easier to enjoy the greens when your finances are already performing.

The issuer of units (Term Accounts) in TermPlus (ARSN 668 902 323) is Pengana Capital Limited (Pengana) (ABN 30 103 800 568, AFSL 226 566). Any advice provided is general in nature and does not take into account your particular objectives, financial situation or needs. Before investing in TermPlus, consider the PDS, TMD and further details on our website at www.termplus.com.au/important-information/.